An accountant can then convert your accrual basis statements to cash basis if it’s needed for a tax return.

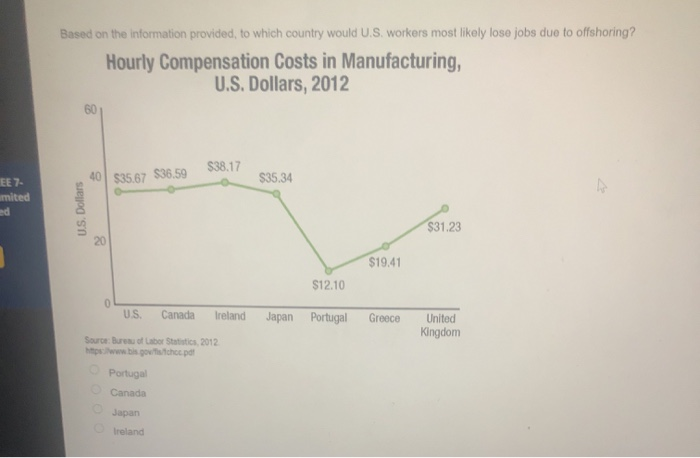

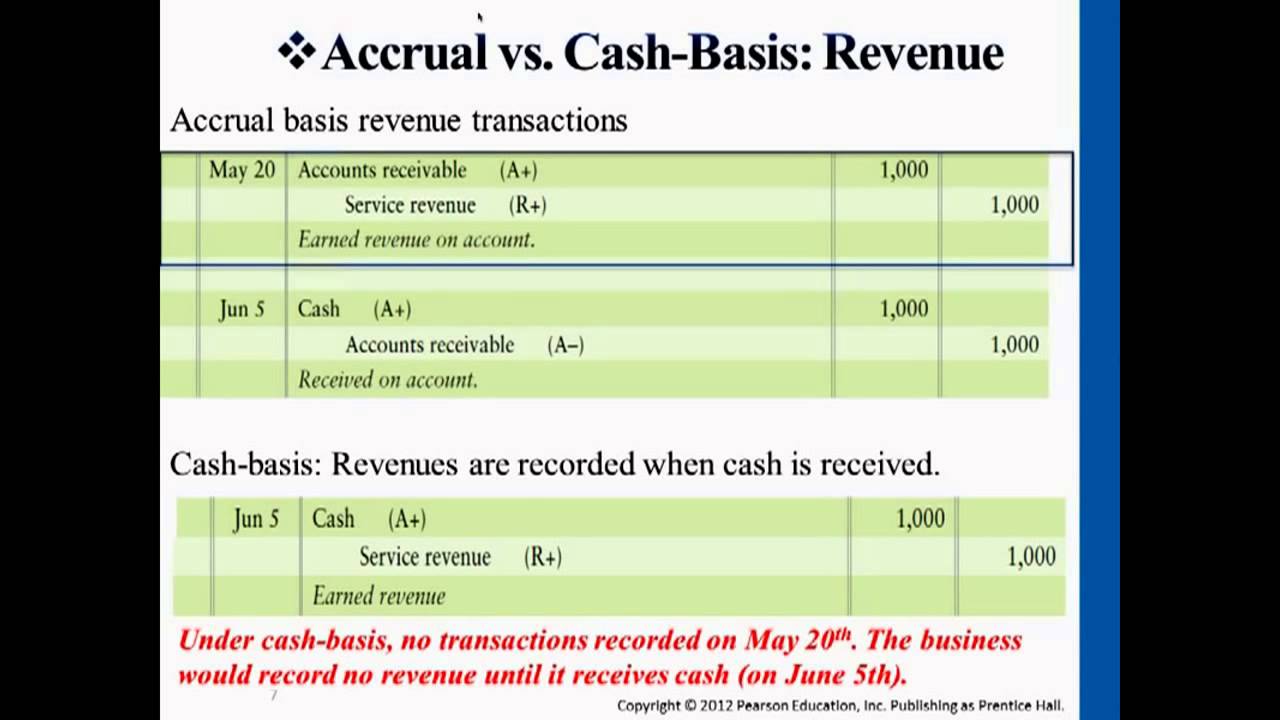

#ACCRUAL BASIS ACCOUNTING RECOGNIZES SOFTWARE#

If your software cannot do this, you should keep your books on the accrual basis. QuickBooks Online can produce either cash or accrual financial statements from the same set of books. For this reason, companies that must comply with GAAP are required to use accrual accounting. Accrual-accounting gives a better picture of the profitability of a company because it generally recognizes revenue in the same period as the expenses to produce that revenue. The accrual-basis of accounting is preferable to the cash-basis of accounting for preparing financial statements to be used by management, bankers, or investors. Hence, accrual records must debit utilities expense and credit utilities payable. Under the accrual method, you need to recognize the utility expense in July because the electricity consumption is for the month of July. To illustrate, let’s assume your business received an electric bill for the month of July, and its due date is on August 10. Accounting standards of the United States generally accepted accounting principles (GAAP) mainly use this method, especially when dealing with complex accounting transactions like foreign currency translations, hedging, and investment accounting. The accrual method recognizes income and expenses when earned or incurred. Since all revenues and expenses are recorded when cash is received or paid, the net income is also the net increase in cash during the period.

Uses simplified accounting: If you connect your bank account to an accounting software program, bank feeds record all your cash transactions in the system automatically-you don’t need to record these transactions manually.With the accrual-basis, you must generate a separate statement of cash flow to get this information. By tracking cash flow, you can assess if the business is generating enough cash to cover cash payments at a given period. Focuses more on cash flow generation: The cash method provides more information on your business’ ability to generate cash.The cash method doesn’t require you to have in-depth accounting knowledge because you only track the cash flow. When you receive cash, you record it as income. Requires little accounting expertise: The cash method is common sense.However, C corporations (C-corps) with less than $25 million in average gross receipts for the past three years, S corporations (S-corps), and partnerships are generally allowed to use the cash method.Īdvantages of the Cash Method of Accounting Not all businesses can use the cash-basis on their tax returns. If you prefer the deduction next year, wait to pay the expense until January. For example, if you prefer a tax deduction in the current year, the expense can be paid at the end of December.

Thus, companies with high income are more likely to have cash flow available to pay taxes.Īnother advantage of cash-basis accounting for income taxes is that it is easier to control the timing of your tax deductions since expenses are deducted when actually paid. This is because the cash-basis of accounting aligns income with cash received. The cash-basis of accounting is generally preferable to the accrual-basis for filing income tax returns. Upon receipt of the bill, you don’t recognize any expense-you only record the expense when you pay the bill. For example, you received a $1,000 bill from a provider for services that were already performed. This method ignores when the legal obligation occurred. The cash method recognizes income and expenses when cash is received or paid. Recognizes bad debt expense for invoices businesses estimate won’t be paid

0 kommentar(er)

0 kommentar(er)